With all the noise about federal budgets, sequesters, debt ceilings and taxes, its sometimes hard to figure out what’s real.

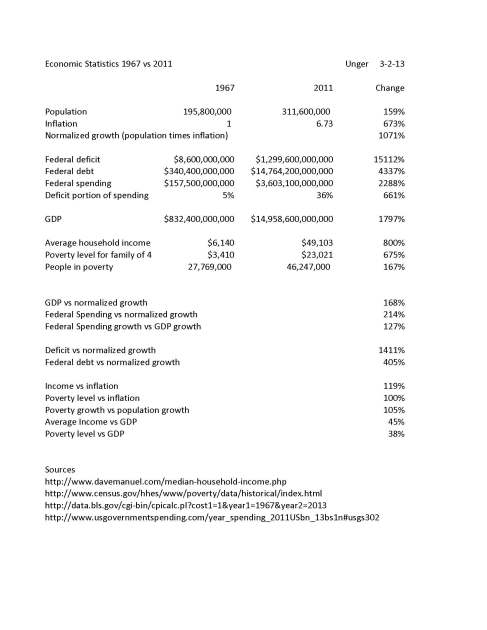

So I spent a little time doing some research using government statistics and basic math this evening. The results are shown on the spreadsheet below comparing various economic factors.

In summary, between 1967 and 2011:

Population growth was 159% and inflation was 673%, which combine to create a normalized growth basis of 1,071%.

Gross Domestic Product grew 168% relative to normalized growth.

Average household income increased 119% relative to inflation but only 45% relative to GDP growth.

The official poverty level stayed flat relative to inflation but increased only 38% relative to GDP growth, while the number of people living below the poverty line increased 105% relative to population growth.

Federal spending grew 214% relative to normalized growth and grew 127% relative to GDP growth.

The deficit portion of federal spending has increased 1,411% relative to normalized growth. In dollars it has increased 15,112%.

Our federal debt has increased 4,337%.

So what conclusions can be drawn from those numbers?

1) Government spending has clearly grown far more than the economy, inflation, population or average family incomes.

2) Our economy is growing faster than normalized growth expectations so productivity is improving. That’s good news. Our society has extra resources to solve problems. We shouldn’t have to borrow.

3) The disparity between GDP growth and average household income growth indicates significant wealth is accumulating that is not accruing to the average household, thus wealth disparities are clearly increasing.

4) Growth in average household income has been better than inflation, but the average household income data shown is presumably skewed by the increasing share of income accruing to wealthy households. Average middle class family incomes are likely holding steady or improving a bit, but that data is hard to tease out of the statistics.

5) Poverty is getting worse in America. Significantly increased government spending has not helped at all to alleviate poverty and likely hasn’t done much good for average middle class households either.

6) It appears that there is plenty of room to cut federal spending to be more in line with normalized growth.

7) Growth in federal deficit spending and debt is dangerously unsustainable and needs to be addressed.

The “tax the rich” vs “cut the budget” rhetoric in Washington is not solving the urgent problem we have of getting the deficit and debt under control. We need to do both.

What the statistics don’t show is there are smart ways and stupid ways to implement both spending cuts and tax revenue increases. There are plenty of programs and entire federal departments that can be selectively eliminated because they frankly aren’t doing anyone any good except the government employees who take home paychecks. Raising tax rates is not the answer when the byzantine tax code is riddled with loopholes for the wealthy to exploit. We should be eliminating all tax loopholes, eliminating the corporate tax altogether and then treating capital gains, dividend income, carried interest and all the other specially favored income categories of the wealthy as regular income taxed at regular rates.

I’d be lying if I claimed to be in agreement with you, but I agree that we need a simpler tax system which doesn’t have 1001 exceptions, loopholes and special case regulations.